The company had a tumultuous 2020 when it was supposed to go public in the world’s largest ipo, which gave the fintech a whopping $313 billion valuation. For startup fintech type, some of them are:

Biggest Fintech In Indonesia, For startup fintech type, some of them are: It’s a very broad definition that includes early stage fintech startups, established startups such as stripe, large tech companies such as ant financial, but also financial institutions such as citi or prudential.

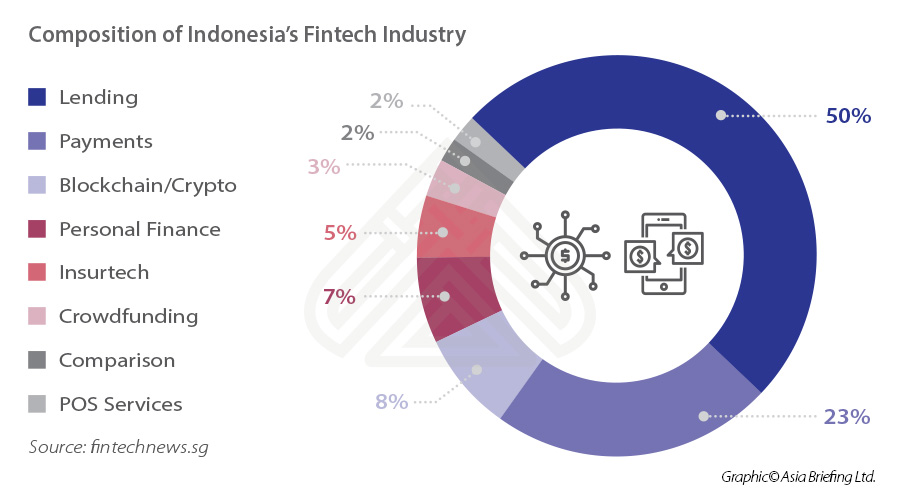

38% indonesian fintech companies are payments startups with 31% p2p lending. The archipelago�s digital ecosystem is still in its nascent stage, experiencing robust growth in each of its subsectors. Fintech products and services have quickly begun to resonate with. For startup fintech type, some of them are:

Crypto transactions have surged to $33 billion and bank indonesia is looking at developing a cbdc.

In 2020, the news reported that a large amount of funding was provided to fintech companies in indonesia. According to medici’s report, 2020 was a defining year for fintech funding in indonesia with over 77 deals garnering $329 million, the highest ever. Appsflyer, an attribution company based in the us, conducted research on over 4.7 billion application installations globally. Indonesia has the largest population in southeast asia and one of the fastest growing economies. Second largest bank by lending assets at 31 march 2017. Payfazz is a fintech startup that was established in 2016.

Source: uobgroup.com

Source: uobgroup.com

The world’s largest cryptoexchange, binance, is currently working with pt bank central asia and pt telekom indonesia to establish an exchange in the country. Digital wallet linkaja closed the most significant fundraising round (series b) at $100 million. The relatively large fintech industry, start up fintech, social fintech and fintech with ‘loan market’ type. It’s a very broad definition that.

Source: fintechnews.sg

Source: fintechnews.sg

Total value of disclosed fintech investment as of 2017 hit $176 million. For startup fintech type, some of them are: Here are the biggest trends that shaped asia’s fintech industry. Saudi arabia’s islamic fintech is the biggest market in the world, with $17.9bn worth of transactions in 2020 while iran is at $9.2bn, uae $3.7bn, malaysia $3.0bn and indonesia $2.9bn..

In the final quarter of 2020, kredivo, a p2p lending platform, secured a debt facility of up to usd 100 million from victory park capital advisors. 38% indonesian fintech companies are payments startups with 31% p2p lending. Then iran with us$ 9.2 billion, united arab emirates us$ 3.7. Looking at fintech lending’s untapped markets, most investors in indonesia (as well.

Source: convergencevc.com

Source: convergencevc.com

Fintech products and services have quickly begun to resonate with. Cb insights reported this year saw $91.5 billion invested by venture capital into fintech, doubling last year’s total. Total value of disclosed fintech investment as of 2017 hit $176 million. In the final quarter of 2020, kredivo, a p2p lending platform, secured a debt facility of up to usd 100.

Source: tellimer.com

Source: tellimer.com

Looking at fintech lending’s untapped markets, most investors in indonesia (as well as regional) are confident about fintech lending’s growth for at least the next three years. Doku, ipaymu, midtrans, kartuku, and dimo. At cfte, our definition of fintech is “the impact that technology has in transforming the financial industry”. The payments sector raised the highest amount of money ($158.

Payfazz is on a mission to empower smes and the rural population with technology to build indonesia’s digital economy. Cb insights reported this year saw $91.5 billion invested by venture capital into fintech, doubling last year’s total. Ovo has become more than just a payment platform, but indonesia�s largest integrated digital ecosystem as it enters its third year in september,.

Source: kr-asia.com

Source: kr-asia.com

The payments sector raised the highest amount of money ($158 million). As of may 2019, 249 fintech companies were found in indonesia, and the number is expected to continue growing in the years to come. A summary of funding activity in indonesia, 1h2021. The world’s largest cryptoexchange, binance, is currently working with pt bank central asia and pt telekom indonesia.

Source: fintechnews.sg

Source: fintechnews.sg

The archipelago�s digital ecosystem is still in its nascent stage, experiencing robust growth in each of its subsectors. Fintech products and services have quickly begun to resonate with. Indonesia’s economy represents about 40% of the. Total value of disclosed fintech investment as of 2017 hit $176 million. Ant group ($78 billion) ant group, also known as ant financial or alipay,.

Source: fintechnews.sg

Source: fintechnews.sg

Transaction value in 2018 projected to be $22 million. Fintech, mobile payments, point of sale, small and medium businesses; Indian fintech giant paytm raised us$2.5 billion in the country’s largest initial public offering (ipo) on november 18, giving it a valuation of us$20 billion. In 2020, the news reported that a large amount of funding was provided to fintech companies.

Source: aseanbriefing.com

Source: aseanbriefing.com

Meanwhile the fintech type that has been longer and quite large, among others: Financial technology, or fintech as its widely referred to these days, has grown rapidly in a short period of time and has since gained higher prominence in indonesia than traditional banking services, making it a critical disruptor of the finance industry in southeast asia’s largest economy. Payfazz.

Source: fintechnews.sg

Source: fintechnews.sg

Capital has never been more available and ready to invest in startups. Saudi arabia’s islamic fintech is the biggest market in the world, with $17.9bn worth of transactions in 2020 while iran is at $9.2bn, uae $3.7bn, malaysia $3.0bn and indonesia $2.9bn. The relatively large fintech industry, start up fintech, social fintech and fintech with ‘loan market’ type. A summary.

Source: fintechnews.sg

Source: fintechnews.sg

In the final quarter of 2020, kredivo, a p2p lending platform, secured a debt facility of up to usd 100 million from victory park capital advisors. Types of fintech industry in indonesia: Digital wallet linkaja closed the most significant fundraising round (series b) at $100 million. Payfazz is on a mission to empower smes and the rural population with technology.

Source: thelowdown.momentum.asia

Source: thelowdown.momentum.asia

At cfte, our definition of fintech is “the impact that technology has in transforming the financial industry”. As of may 2019, 249 fintech companies were found in indonesia, and the number is expected to continue growing in the years to come. Crypto transactions have surged to $33 billion and bank indonesia is looking at developing a cbdc. The relatively large.

Source: uobgroup.com

Source: uobgroup.com

Transaction value in 2018 projected to be $22 million. In the final quarter of 2020, kredivo, a p2p lending platform, secured a debt facility of up to usd 100 million from victory park capital advisors. Fintech sucked up one in every five vc bucks. Ovo has become more than just a payment platform, but indonesia�s largest integrated digital ecosystem as.

Source: kr-asia.com

Source: kr-asia.com

In 2020, the news reported that a large amount of funding was provided to fintech companies in indonesia. 38% indonesian fintech companies are payments startups with 31% p2p lending. Capital has never been more available and ready to invest in startups. Meanwhile the fintech type that has been longer and quite large, among others: Ovo has become more than just.

Source: fintechnews.sg

Source: fintechnews.sg

However, the market size of indonesia’s islamic fintech is still below saudi arabia, iran, united arab emirates (uae) and malaysia. Fintech sucked up one in every five vc bucks. Indonesia has the largest population in southeast asia and one of the fastest growing economies. Transaction value in 2018 projected to be $22 million. The relatively large fintech industry, start up.

Source: iprice.co.id

Source: iprice.co.id

Indonesia’s economy represents about 40% of the. In the final quarter of 2020, kredivo, a p2p lending platform, secured a debt facility of up to usd 100 million from victory park capital advisors. Appsflyer, an attribution company based in the us, conducted research on over 4.7 billion application installations globally. The payments sector raised the highest amount of money ($158.

Source: researchgate.net

Source: researchgate.net

Appsflyer, an attribution company based in the us, conducted research on over 4.7 billion application installations globally. Indonesia’s economy represents about 40% of the. Crypto transactions have surged to $33 billion and bank indonesia is looking at developing a cbdc. Ovo claims it�s now indonesia�s largest fintech ecosystem. Indian fintech giant paytm raised us$2.5 billion in the country’s largest initial.

Source: fintechnews.sg

Source: fintechnews.sg

However, the market size of indonesia’s islamic fintech is still below saudi arabia, iran, united arab emirates (uae) and malaysia. The market�s largest segment will be digital payments with a total transaction value of us$64,741m in 2022. At cfte, our definition of fintech is “the impact that technology has in transforming the financial industry”. Ovo claims it�s now indonesia�s largest.

Source: fintechnews.sg

Source: fintechnews.sg

Fintech is now a crucial component of the country’s financial services sector. Total value of disclosed fintech investment as of 2017 hit $176 million. Crypto transactions have surged to $33 billion and bank indonesia is looking at developing a cbdc. This company has been operating since 2015, and it offers fintech services for online transactions, payment gateway, money transfer facilities,.

Source: fintechnews.sg

Source: fintechnews.sg

Appsflyer, an attribution company based in the us, conducted research on over 4.7 billion application installations globally. Digital wallet linkaja closed the most significant fundraising round (series b) at $100 million. Second largest bank by lending assets at 31 march 2017. Here are the biggest trends that shaped asia’s fintech industry. The fintech alone accounts for usd 904 million of.

Source: aseanbriefing.com

Source: aseanbriefing.com

Cb insights reported this year saw $91.5 billion invested by venture capital into fintech, doubling last year’s total. In 2020, the news reported that a large amount of funding was provided to fintech companies in indonesia. According to medici’s report, 2020 was a defining year for fintech funding in indonesia with over 77 deals garnering $329 million, the highest ever..

Source: fintechnews.sg

Source: fintechnews.sg

This company has been operating since 2015, and it offers fintech services for online transactions, payment gateway, money transfer facilities, etc. 38% indonesian fintech companies are payments startups with 31% p2p lending. Financial technology, or fintech as its widely referred to these days, has grown rapidly in a short period of time and has since gained higher prominence in indonesia.

Source: uobgroup.com

Source: uobgroup.com

Some of the promising fintech startups in indonesia include jurnal, cashlez, tunaikita, payfazz, and koinworks. The company had a tumultuous 2020 when it was supposed to go public in the world’s largest ipo, which gave the fintech a whopping $313 billion valuation. Total value of disclosed fintech investment as of 2017 hit $176 million. The relatively large fintech industry, start.

Source: fintechnews.sg

Source: fintechnews.sg

Appsflyer, an attribution company based in the us, conducted research on over 4.7 billion application installations globally. Indian fintech giant paytm raised us$2.5 billion in the country’s largest initial public offering (ipo) on november 18, giving it a valuation of us$20 billion. Fintech products and services have quickly begun to resonate with. The payments sector raised the highest amount of.